Three-quarters of media buyers (74 percent) think the coronavirus (COVID-19) pandemic’s impact on the U.S. advertising industry will be worse than the 2008 financial crisis, according to a survey of buy-side decision-makers by ad industry trade group the Interactive Advertising Bureau.

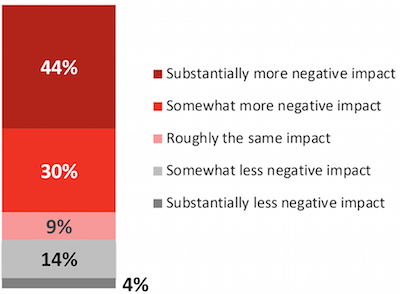

Of that 74 percent, a majority (44 percent) said they think the coronavirus outbreak would have a “substantially more negative impact” than the 2008 financial crisis.

COVID-19's impact on 2020 U.S. ad budgets compared to the 2008 financial crisis. COVID-19's impact on 2020 U.S. ad budgets compared to the 2008 financial crisis. |

A majority (70 percent) of the media buyers polled said they’ve already made changes to their ad spending activities. Nearly a quarter (24 percent) of them said they’ve paused all advertising for the remainder of the Q1 and Q2 period.

Digital ad spending in the U.S. is currently down 33 percent and traditional media is down 39 percent, according to the report.

The IAB report also found that nearly two-thirds (63 percent) of advertisers have already changed the messages they’re touting in light of COVID-19, with 42 percent of them reporting that they’re increasing mission-based marketing and 41 percent saying they’re increasing cause-related marketing.

Most media buyers see Q2 as pretty much a wash at this point, and two-thirds can’t say yet if they’re making ad spending changes in 2020’s second half. But advertisers said the top milestones they’re looking for in order to recalibrate their budgets in the future are quarantine status (65 percent) and shelter-in-place initiatives (62 percent), followed by the number of coronavirus cases (49 percent), business openings and closings (47 percent) and stock market performance (44 percent).

Interpublic research firm Magna Global has anticipated that ad spends in the U.S. would decline 2.8 percent this year in light of the COVID-19 pandemic.

IAB’s report, “Coronavirus Ad Spend Impact: Buy-Side,” surveyed 400 buy-side decision-makers at agencies or brands in late March.

Abandon traditional content plans focused on a linear buyer progression and instead embrace a consumer journey where no matter which direction they travel, they get what they need, stressed marketing pro Ashley Faus during O'Dwyer's webinar Apr. 2.

Abandon traditional content plans focused on a linear buyer progression and instead embrace a consumer journey where no matter which direction they travel, they get what they need, stressed marketing pro Ashley Faus during O'Dwyer's webinar Apr. 2. Freelance marketers and the companies that hire them are both satisfied with the current work arrangements they have and anticipate the volume of freelance opportunities to increase in the future, according to new data on the growing freelance marketing economy.

Freelance marketers and the companies that hire them are both satisfied with the current work arrangements they have and anticipate the volume of freelance opportunities to increase in the future, according to new data on the growing freelance marketing economy. Home Depot's new attempt to occupy two market positions at once will require careful positioning strategy and execution to make it work.

Home Depot's new attempt to occupy two market positions at once will require careful positioning strategy and execution to make it work. Verizon snags Peloton Interactive chief marketing officer Leslie Berland as its new CMO, effective Jan. 9. Berland succeeds Diego Scotti, who left Verizon earlier this year.

Verizon snags Peloton Interactive chief marketing officer Leslie Berland as its new CMO, effective Jan. 9. Berland succeeds Diego Scotti, who left Verizon earlier this year.  Norm de Greve, who has been CMO at CVS Health since 2015, is taking the top marketing job at General Motors, effective July 31.

Norm de Greve, who has been CMO at CVS Health since 2015, is taking the top marketing job at General Motors, effective July 31.

Have a comment? Send it to

Have a comment? Send it to

No comments have been submitted for this story yet.