As clients scale back their marketing budgets in response to the COVID-19 pandemic, PR firms are reporting an upswing in layoffs and salary cuts, as well as terminated client contracts and campaigns put on hold, according to a new industry survey conducted by PR merger and acquisition consultancy Gould+Partners.

The Gould+Partners report, which sought to gauge the coronavirus’ impact on the PR profession, found that, on average, six percent of the agencies surveyed said they’d been forced to lay off staff. An additional 21 percent reported mandatory pay cuts, and two percent reported voluntary staff cuts.

Layoffs appeared to hit the smallest firms surveyed—those with less than $3 million in revenues—slightly more (seven percent), while the largest firms—those with revenues in excess of $25 million—enacted the greatest mandatory staff pay cuts (43 percent).

Firms across the board also reported lost revenues. On average, about a quarter of the agencies surveyed (24 percent) said clients had requested that their work with the agency be put “on pause” because of the COVID-19 crisis. An additional 13.75 percent said clients had requested reductions in retainers or projects. Overall, 8.5 percent of agencies surveyed said they’d had client contracts terminated.

Once again, the smallest firms surveyed—those with less than $3 million in revenues—appeared to have been hit hardest, with 19 percent reporting client requests to put work “on pause,” 13 percent claiming they’d had contracts terminated and 10 percent getting client requests for retainer/project reductions.

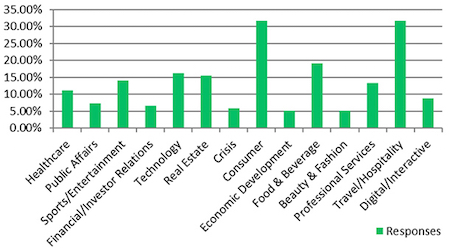

PR specialties that have taken the hardest hit due to the COVID-19 pandemic. PR specialties that have taken the hardest hit due to the COVID-19 pandemic. |

The average amount of time for PR campaigns to be put on hold was 2.6 months. The largest firms surveyed—those with revenues of more than $25 million—revealed the greatest average “on pause” request time from clients, at 3.4 months. More than a third of those firms—36 percent—also reported “on pause” requests from clients, the largest number reported.

According to the survey, 90 percent of the agencies polled said they would be applying for a small business loan under the CARES ACT loan program.

When it comes to what PR specialties are taking the hardest hit in light of the COVID-19 pandemic, nearly a third of agencies specializing in travel/hospitality (31.6 percent) and consumer PR (31.6 percent) reported losses. PR specialties focused on food and beverage (19.1 percent), technology (16.2 percent), real estate (15.4 percent) and sports/entertainment (14.0 percent) followed.

Healthcare and crisis specialties appeared to hold their own despite the outbreak, as did practices specializing in economic development, financial/investor relations and beauty and fashion. In fact, more than a third of the firms surveyed said their crisis practices (36.8 percent) and healthcare practices (37.5 percent) are actually financially improving.

Gould+Partners managing partner Rick Gould told O’Dwyer’s that we might expect these stats to change in the coming days and weeks in regard to lost client fees, staff layoff numbers and firms taking advantage of the CARES program.

“In this uncertain time within the PR industry, with firms sharing with me that they are in ‘survival mode’ and not knowing what to do regarding client loss of income, staff layoffs and applying for the CARES Payroll Protection Plan, I thought using our established benchmarking software and knowledge of the PR industry could add value in the decision-making process,” Gould said. “I know travel PR firms that have lost 50 percent of their book of business in a ten-day period. These were very successful, very profitable, established firms that watched their hotel/hospitality clients exit the door… one by one.”

A March study released by professional social network Fishbowl discovered that nearly two-thirds of marketing industry professionals surveyed (65 percent) believe the COVID-19 pandemic will lead to layoffs at their agency.

Gould+Partners’ “Coronavirus Financial Crisis Impact—Report #1” was based on the responses of CEOs from about 140 PR agencies throughout North America at the beginning of April.

There’s a fine line between newsjacking and taking advantage, aka ambulance chasing. Our job as PR professionals is to tread it carefully.

There’s a fine line between newsjacking and taking advantage, aka ambulance chasing. Our job as PR professionals is to tread it carefully. PR firms need to be mindful of ways their work product may be protected by the attorney-client privilege whenever working with a client’s internal legal team or its external legal counsel.

PR firms need to be mindful of ways their work product may be protected by the attorney-client privilege whenever working with a client’s internal legal team or its external legal counsel. Manuel Rocha, former US ambassador and intenational business advisor to LLYC, plans to plead guilty to charges that he was a secret agent for Cuba.

Manuel Rocha, former US ambassador and intenational business advisor to LLYC, plans to plead guilty to charges that he was a secret agent for Cuba. CEO mentoring is an often-overlooked aspect of why CEOs are able to make good decisions, and sometimes make bad ones—all of which intersects with the role and duties of a board.

CEO mentoring is an often-overlooked aspect of why CEOs are able to make good decisions, and sometimes make bad ones—all of which intersects with the role and duties of a board.  How organizations can anticipate, prepare and respond to crises in an increasingly complex world where a convergent landscape of global challenges, threats and risks seem to arrive at an unrelenting pace.

How organizations can anticipate, prepare and respond to crises in an increasingly complex world where a convergent landscape of global challenges, threats and risks seem to arrive at an unrelenting pace.

Have a comment? Send it to

Have a comment? Send it to

No comments have been submitted for this story yet.