The COVID-19 pandemic has dealt a devastating blow to the U.S. public relations industry, resulting in client reductions across the board and plummeting revenues that have agencies of all sizes cutting staff to make up for the losses, according to a new report by PR merger and acquisition consultancy Gould+Partners.

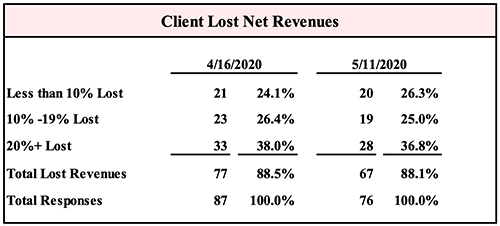

The Gould+Partners report, which sought to gauge the coronavirus’ financial impact on the U.S. PR sector and how the industry is moving forward, found that 67 of the 76 firms polled (88.1 percent) said they’d lost client revenues as a result of COVID-19. More than a third of those firms (36.8 percent) reported losing more than 20 percent of their client revenues. A quarter (25 percent) lost between 10 percent and 19 percent, while an additional 26.3 percent experienced client terminations of 10 percent or less.

These figures actually show a slight improvement from a previous Gould+Partners report in April, which found that 88.5 percent of agencies surveyed said they’d lost client net revenues due to COVID-19.

|

Firms across the board reported lost revenues, but they appeared to hit the smallest firms surveyed—those with less than $3 million in revenues—hardest, where net revenues losses largely ran the gamut between 10 and 49 percent. Two firms in this category reported losing more than 50 percent of their net revenues due to COVID-19. The largest firms surveyed, meanwhile—those with revenues in excess of $25 million—reported the smallest losses, with a majority of losses coming in at the 10 percent or less range.

The good news: only 1.6 percent of the PR firms surveyed reported terminating staff in light of the COVID-19 crisis. The largest staff cuts came from the largest firms surveyed—those with revenues in excess of $25 million—3.8 percent of whom reported terminating staff. Staff terminations were lowest among the smallest firms surveyed—those with less than $3 million in revenues—only one percent of whom reported cuts.

Staff furloughs, unsurprisingly, were more common, affecting 2.6 percent of the firms surveyed. Interestingly, the largest amount of furloughs came from the middle-sized agencies, or those with between $3 million and $10 million in revenues (5.1 percent). Firms with between $10 million to $25 in revenues were least likely to furlough staff (one percent). Agencies that issued a mandatory temporary leave of absence reported an average furlough time period of 1.9 months.

An April Gould+Partners report discovered that 13.8 percent of U.S. PR firms polled had been forced to furlough staff and 5.7 percent had experienced layoffs. Nearly one in five—18.4 percent—said they’d instituted mandatory pay cuts.

According to the report, every eligible PR firm surveyed filed for a small business loan under the Small Business Administration’s Paycheck Protection Program. The average amount of time it took for agencies to receive the funds after applying was about two weeks (14.9 days).

“I am actually surprised that 100 percent of firms have not lost revenue from COVID-19. Every firm that I have personally talked to had terminations and/or a ‘pause’ in their retainers and projects. Luckily, the total ‘average’ loss of revenue was lower than we initially anticipated,” Gould+Partners managing partner Rick Gould told O’Dwyer’s. “My concern is this … the firms that lost substantial revenues, applied for PPP funding, received it, which will carry the staff that would have been laid off for eight weeks. Those firms may be in a bind at the end of the eight weeks. They now must retain those employees that were the basis for PPP funding and may not have the work and/or revenues to support those employees. They will then have to pay back part or all of the PPP loan. The PPP loan will only be forgiven if the firm retains those employees. What I believe must happen is for the eight weeks to be extended to at least sixteen weeks to give the firms a fighting chance to recapture the lost income.”

Gould+Partners’ “PR Firm Coronavirus Financial Crisis Report” surveyed 76 anonymous agencies across North America in May. The firms surveyed earned annual revenues ranging from less than $3 million to more than $25 million.

DJE Holdings, parent of Edelman and Zeno, launches RUTH as an independent shop named after Ruth Edelman, mental health advocate, wife and longtime business partner of Dan Edelman.

DJE Holdings, parent of Edelman and Zeno, launches RUTH as an independent shop named after Ruth Edelman, mental health advocate, wife and longtime business partner of Dan Edelman. New York City PR firms make up the largest slice of O'Dwyer's 147 firm overall ranking with 33 of 40 in the New York/New Jersey area either calling Manhattan their home or having a presence there.

New York City PR firms make up the largest slice of O'Dwyer's 147 firm overall ranking with 33 of 40 in the New York/New Jersey area either calling Manhattan their home or having a presence there. Subject Matter+Kivvit, which joined forces in May, has rebranded as Avoq, an integrated shop with more than 200 professionals in Washington, New York, Asbury Park (NJ), Miami and Chicago.

Subject Matter+Kivvit, which joined forces in May, has rebranded as Avoq, an integrated shop with more than 200 professionals in Washington, New York, Asbury Park (NJ), Miami and Chicago. While PR pros stationed at in-house comms. teams and those working for agencies share many of the same objectives, they also have markedly different top priorities, according to a recent report.

While PR pros stationed at in-house comms. teams and those working for agencies share many of the same objectives, they also have markedly different top priorities, according to a recent report. Edelman is cutting 240 employees or about four percent of its workforce to cope with the cooling down of the PR sector, according to a memo from CEO Richard Edelman.

Edelman is cutting 240 employees or about four percent of its workforce to cope with the cooling down of the PR sector, according to a memo from CEO Richard Edelman.

Have a comment? Send it to

Have a comment? Send it to

No comments have been submitted for this story yet.