|

Brand has a powerful effect on a company’s valuation, but the level of brand understanding in the investment community leaves a lot to be desired, according to a new study from brand consultancy Interbrand, B2B research company NewtonX and strategic communications company Brodeur Partners.

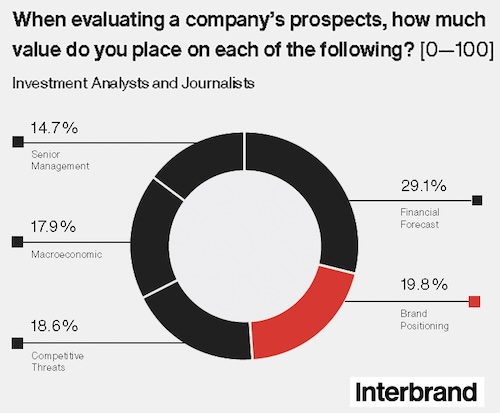

Their “How Brand Impacts Share Price” report finds that more than three-quarters (76 percent) of the investor relations pros, analysts and journalists surveyed said that brand has “a meaningful impact on valuation.” They placed it second only to “financial forecast” among the top factors shaping a company’s valuation.

The relationship between brand issues and a company’s Price to Earnings ratio is also considered important, with 54 percent saying brand has a moderate impact on the PE Ratio and 22 percent saying it has a large impact.

|

But despite that importance, a detailed knowledge of the brand positioning and strategy of their target/portfolio companies seems to be beyond the reach of all but a few respondents. Only 10 percent of journalists and analysts said that they have a “deep understanding” of those brand issues, and that number drops to 3 percent for investor relations pros.

However, more than a third (35 percent) of journalists and analysts say that they are at least “sometimes” briefed by the company they are evaluating, with 28 upping that estimate to “often” and 11 percent saying they are briefed “almost always” or “always.” Only seven percent say they are never briefed.

Many of them would like for the frequency of those briefings to increase, with 28 percent saying they would like be briefed “almost always/always,” 36 percent opting for “often” and 25 precent want to receive briefings “sometimes.”

The report suggests several key steps to make sure a brand’s position is effectively represented in the investment community, helping to bridge any valuation disconnect.

One is to develop a brand valuation model, showing how brand strength, the role of a brand and a company’s financial performance work together to deliver shareholder returns.

The study also suggests that companies do research to find out how the investment community perceives their brand—and where there are disconnects between that perception and a brand’s true position.

Using that information, the authors cite the need to “determine what isn’t working for your brand in order to change perceptions.”

The Interbrand/NewtonX/Brodeur Partners study was conducted from Dec 1 through Jan 10.

Consumers who once demanded convenience now require consistent, multi-channel experiences that cater to them at every point. Brands must have a clear, audience-appropriate, and channel-specific voice across all platforms.

Consumers who once demanded convenience now require consistent, multi-channel experiences that cater to them at every point. Brands must have a clear, audience-appropriate, and channel-specific voice across all platforms. Employees at U.S. companies are experiencing high levels of burnout, but managers are lagging behind when it comes to their awareness of the problem

Employees at U.S. companies are experiencing high levels of burnout, but managers are lagging behind when it comes to their awareness of the problem AI may still be viewed with a wary eye by most media pros, but its use is growing, according to a new study from Muck Rack.

AI may still be viewed with a wary eye by most media pros, but its use is growing, according to a new study from Muck Rack. A new study from Walker Sands says that some marketers have been putting the cart before the horse when it comes to the relationship between marketing channels and business outcomes.

A new study from Walker Sands says that some marketers have been putting the cart before the horse when it comes to the relationship between marketing channels and business outcomes. Thought leadership can make made B2B brands more "powerful and attractive to buyers," according to Edelman report.

Thought leadership can make made B2B brands more "powerful and attractive to buyers," according to Edelman report.

Have a comment? Send it to

Have a comment? Send it to

No comments have been submitted for this story yet.